Or an unstoppable "A to Z" business model? Let's tell it like it is ... Amazon is a growing monopoly ... a monopoly that is slowly devouring the entire retail marketplace. This Seattle supercompany is doing this with a business model that exhibits at least one classic trait of a monopoly -- pricing offerings at a loss in order to grab market share away from its competition. It can do this for four main reasons:

1) It has a highly efficient and effective distributed warehouse operation based on automation and tough personnel policies that keep its customers very content.

2) The Internet has provided Amazon a real-time ordering system that is extremely convenient to its customers ... centered around its sophisticated server farms. These server farms are also the basis of Amazon's Cloud Services which generate the bulk of its profits ... which then carry the generally unprofitable much bigger on-line retail operations. There are a few other revenue streams like Kindle and Echo.

3) An extensive and sophisticated American parcel delivery infrastructure headed by the U.S. Postal Service, UPS, FedEx and Amazon's own growing in-house capability. In fact, many analysts believe that Amazon has, in its strategic quiver, designs to eventually vertically integrate to totally control it's own delivery system.

4) Due to these previously mentioned operational advantages ... and solid cash flow due to much depreciation of plant, Amazon enjoys a stratospheric price-earnings ratio (181 at last count vs. a market average of around 18) and an outstanding credit rating. This allows them to cheaply finance its ambitious expansionist plans ... including its recently announced purchase of Whole Foods.

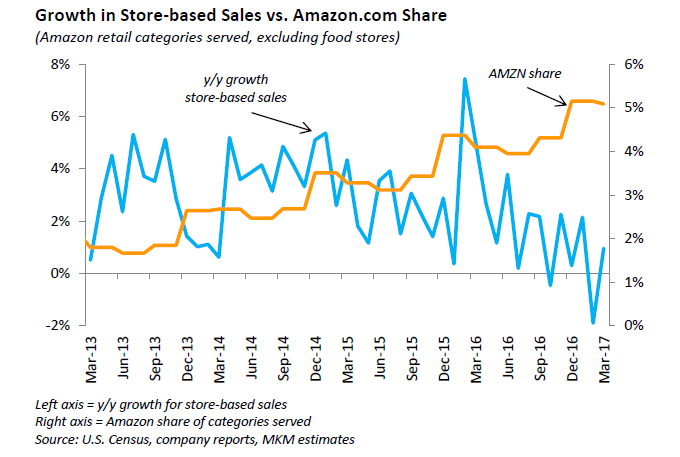

The end result of this superior business model is that Amazon has strategic advantages that seem impossible for classic destination stores to overcome. The question really is: Is this a good monopoly or a bad monopoly? Here is a chart that puts this crushing advantage into perspective:

This chart is from: CNBC Article. Now Jeff Bezos and Company is moving into food. What is next ... Clothing? Shoes? Furniture? Cars? Building materials? Is there nothing that is sold in stores that cannot be sold online through Amazon?

Already there is talk of shopping malls closing because of the "Amazon effect". And this effect does seem unstoppable ... because of the good parts of this company (#1 and #2 above). But it also requires the bad parts (#3 and #4) to make this all possible. The question then becomes: Should the government step in before there is only one retail stock left to buy -- AMZN?

This is a question for Ayn Rand to answer if she were still alive. I know instinctively that our government won't allow us just one huge retail option ... but to step in and stop the Amazon juggernaut will make millions of their customers unhappy. And it will be turning the term "free market" on its head.

I'm happy that this very tough decision is not up to me ...

No comments:

Post a Comment