VAT stands for value-added tax ... a federal consumption tax raised in steps from corporations and the ultimate end users ... and implemented in most of America’s trading partners. The United States does not use such a tax and, as will be demonstrated, this puts us at a distance trading disadvantage.

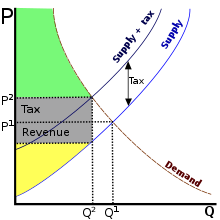

Let me explain ... most of Europe, Mexico, Canada and Asia have a VAT ... an effective sales tax that is applied at each stage in the manufacturing process as a product passes up the supply chain. In effect, a VAT is a tax applied against a finished products’ Cost of Goods ... less such taxes already paid ... up and down the supply chain, effectively a regressive sales tax on the final sales price. For a fuller explanation, see: Investopedia Explanation.

However, here is the rub ... in countries with VATs, when a product is exported, the VAT taxes paid by the seller is remitted. An example of this would be that US travelers to Europe can apply for a rebate any VAT taxes paid in their travels for goods that they are returning home with. (they seldom do however.)

What does this mean? It effectively means that countries with VATs are subsidizing their exports by the cumulative amount of the VAT taxes that had been paid during their manufacture. This, combined with any import tariffs into these countries establishes their mercantilism. This edge puts the U.S., with no VAT, at a very distinct disadvantage trading-wise. However, Trump’s tariffs have begun to close this gap in some places.

Why doesn’t America have a VAT, or national sales tax in order to level the playing field? For a number of reasons, but primarily because of the fear that we will end up with this national sales tax AND a corporate income tax. Not a happy thought.

No comments:

Post a Comment